As wildfires in the US and rising temperatures in European countries augment the Anthropocene reality, regulators worldwide underscore the responsibility of corporations to mitigate the effects of climate change. Europe’s central bank published results illustrating the capacity, or lack thereof, of banks to verify climate risk stress-testing against existing frameworks. EU’s Platform on Sustainable Finance issued a call for feedback on EU Taxonomy and will soon update the minimum safeguards for upholding governance and human rights principles. Asset managers in the EU will now be accountable for meeting investor ESG expectations under a new MiFID II obligation. In a separate call for attention to biodiversity, TNFD published the second version of its nature-related risk framework. The UK introduced legislation to support the redirecting of capital flows towards green activities. In the Americas, the US Fed released a study on climate-related financial stability risks. Brazil’s judiciary branch set landmark precedent in the region by acknowledging climate rights as human rights. Brazil also identified pension funds as a vehicle for sustainability risk management, issuing guidance for soon to be mandatory materiality assessment for insurers. Asia’s path towards sustainable finance continues with Singapore leading by example. The country’s exchange authority MAS published sustainability reporting guidelines for ESG-labeled funds. In India, the central bank RBI is taking steps to assess the banking sector’s climate resilience. This month’s regulatory roundup indicates continued concerns around sustainability issues extending beyond the ‘E’ in ESG.

Europe

Draft report by the Platform on Sustainable finance on minimum safeguards

On 11 July 2022, the Platform on Sustainable Finance issued a call for feedback on a draft report on minimum safeguards. The minimum safeguards set out in Article 18 of the Taxonomy Regulation require that companies implement procedures to comply with OECD Guidelines for multinational enterprises and the UN guiding principles on business and human rights. The report on minimum safeguards aims to provide advice on how compliance with minimum safeguards could be assessed. The deadline for comments on the draft report is 22 August 2022. Read more.

ECB’s climate stress test exercise results published

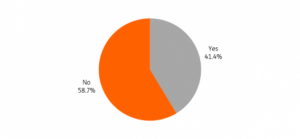

Banks must sharpen their focus on climate risk, ECB supervisory stress test shows. The results of the European Central Bank (ECB) climate risk stress test published on 8 July 2022 show that banks do not yet sufficiently incorporate climate risk into their stress-testing frameworks and internal models, despite some progress made since 2020. The results of the first module show that around 60% of banks do not yet have a climate risk stress-testing framework. Similarly, most banks do not include climate risk in their credit risk models, and just 20% consider climate risk as a variable when granting loans. Banks currently fall short of best practices, according to which they should establish climate stress-testing capabilities that include several climate risk transmission channels (e.g., market and credit risks) and portfolios (e.g., corporate and mortgage). Read more.

Share of banks currently including climate risk in their stress test frameworks

New MiFID II obligation requires asset managers to identify client sustainability preferences

A new ESG rule requiring discretionary fund managers to identify clients’ sustainability preferences came into force on August 2. The rule which was introduced as an amendment to the Markets in Financial Instruments Directive (MiFID II) requires asset managers and financial advisers to consider and incorporate the preferences of retail clients. First, the rule creates a redressal mechanism for investors who otherwise would not be able to hold asset managers accountable for low performing ESG funds. Second, it provides clients with three options under its definition of sustainability – an alignment with the EU Taxonomy, percentage investments defined in SFDR and consideration of PAIs. Read more

TNFD releases beta version of nature-related risk framework

TNFD released the second version of its disclosure framework that includes metrics and guidelines for producing nature-positive outcomes. The Taskforce was established in June 2021 to create an integrated nature-related risk management and disclosure framework for companies. Currently, TNFD is developing a science-based approach with measurable objectives by building on feedback from market participants and aligning with standard setters, regulatory bodies, and other policy practitioners. Read more.

United Kingdom

UK Parliament introduces Financial Services and Markets Bill

The UK House of Commons has introduced legislation to implement the outcomes of the Future Regulatory Framework and regulate the financial services sector within the context of an EU-emancipated market. The government seeks to maintain the UK’s position as an international financial hub in a post-Brexit world and encourages the financial services sector to become globally competitive, green, and technology driven to deliver its vision. The omnibus bill also aligns the growth objectives of the financial services sector with net zero emissions targets. If adopted, the net zero principle would be codified in UK environmental law. In the bill, new powers have been delegated to UK authorities – the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).FCA and PRA will provide guidance and conduct reviews of regulated entities in the financial services sector. Read more.

Americas

US Federal Reserve released a climate-related financial stability study

The United States Federal Reserve published a study on financial system vulnerabilities of climate change. In the report, the Fed uses several modeling approaches and literature review of Climate-Related Financial Stability Risks (CRFSRs) to identify and assess vulnerabilities in the United States. A key objective of this report is to illustrate the use of major methodologies to evaluate the potential vulnerabilities of the financial system to climate change. The key findings reveal “thin” CRFSRs data and lack of certainty due to qualitative assessments. The Fed concludes that a single methodology fails to address, in practice, salient challenges such as long-time horizons, incorporating technological change and modeling disruptions to measure economic impacts of climate change. For a comprehensive analysis of CRFSRs the report recommends using several combined methodologies. Read more.

Brazilian Supreme Court recognizes the Paris Agreement as a human rights treaty

Brazil’s judiciary issued a ruling related to a series of climate change litigation cases acknowledging the underuse of resources in the Climate Fund that should be annually allocated. The ruling indicts the Federal Government that is tasked with the allocation of fund resources towards sustainability issues. Read more.

Brazilian regulator issues sustainability requirements guidelines for the insurance sector

The Brazilian Superintendence of Private Insurance has set forth mandatory ESG reporting requirements for the Brazilian insurance sector. The regulation includes guidance for integrating sustainability-related risk management. Upon enforcement, regulated entities including insurance companies and pension funds must prepare a triennial materiality assessment to identify and classify the risks to which entities are exposed. The materiality assessment extends to indirect exposure through product and services. Read more.

Asia

Singapore exchange authority issues guidelines for issuing ESG funds

Singapore financial regulatory authority MAS has declared that any ESG labeled fund will have to provide evidence of compliance in accordance with its recently published reporting and disclosure guidelines. The latest regulation tackles the issue of greenwashing and increases transparency for retail investors. ESG funds will be monitored on an ongoing basis and investors will be required to provide disclosure as the need arises. Funds will have to account for the integration of ESG KPIs in the investment strategy and portfolio construction. Funds that use “sustainable” and “green” as a key or limited aspect of communication must ensure that net assets are invested according to the non-financial investment strategy included in the prospectus. Read more.

India’s Central Bank calls on industry to set green finance targets

The Reserve Bank of India (RBI) has released a discussion paper on Climate Risk and Sustainable Finance and invited comment from regulated entities in the banking sector and relevant stakeholders. The comment period closes by September 30, 2022. In the discussion paper, the RBI assesses the preparedness and resilience of banks in the face of climate risks and environmental risks. The RBI proposes an elaborate strategy or “risk appetite framework’ for assessing climate-related risks which can be implemented in the short, medium, and long-term. Examples of good practices for the integration of climate-related risk indicators include carbon metrics such as carbon intensity and absolute emissions. The proposed strategy, if adopted, would also require banks to publish stress tests and scenario analysis. Read more.

Other News & Resources

- International Securities Lending Association calls for clarity on ESG collateral rules: Industry body suggests the market would benefit from regulatory certainty on the extent to which asset owners and managers should consider ESG risks when accepting collateral.

- ICMA issues KPI Registry for sustainability linked bonds: The association published guidelines to clarify targets for SLBs and support the growth of the sustainable bond market.

- ISSB publishes ‘landmark’ draft sustainability disclosures: The standard-setting body released much awaited draft disclosure framework that could serve as a global baseline for sustainability disclosures.

- ISSB request for feedback to inform the development of its disclosure for digital reporting: IFRS is consulting on the first two proposed disclosure standards until July 29, 2022.

- CBI formulates a climate resilience taxonomy: The Climate Bonds Initiative announced its plan to release a ‘climate resilience taxonomy’ once it has revised its methodologies for green bonds, social and sustainability bonds.