The proliferation of sustainability data has come at a (not so trivial) cost to data preparers (who are usually the reporting companies themselves), investors, NGOs, academia and other stakeholders like regulators and policymakers. In light of the relatively nascent nature and obscurity of sustainability disclosures, it comes as no surprise that the collection, systematization and analysis of Environmental, Social and Governance (ESG) data metrics entails significant time resources and financial expenditure.

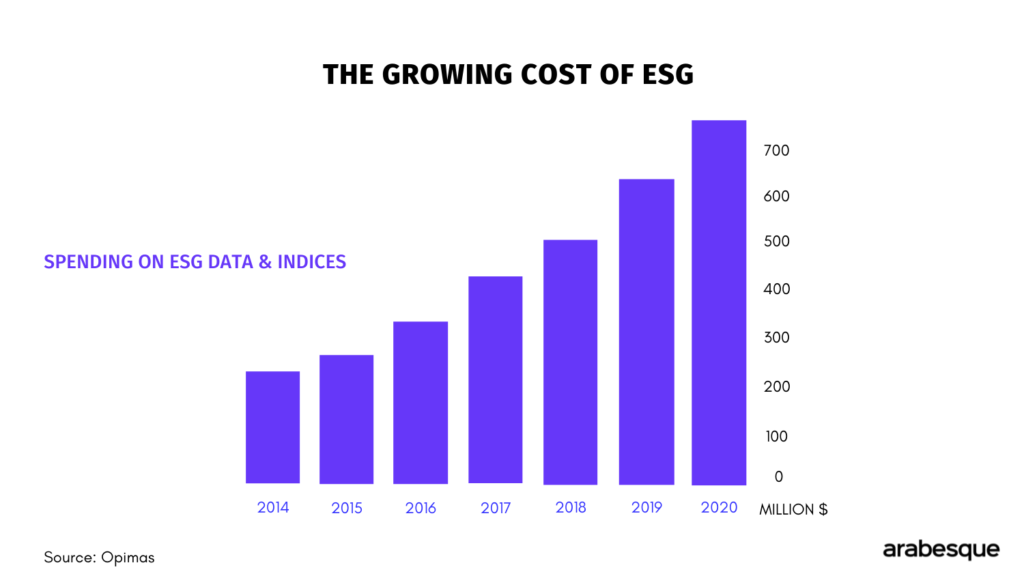

As spending on ESG data continues to grow at an annual rate of 20%, it is projected to reach USD 1 billion by the end of 2021 [1]. This in turn has created arbitrage opportunities for incumbents and established market players who seek to profit from limited transparency and the high barriers to entry related to ESG data provision.

With the reliance on ESG data intensifying, there are significant opportunities for lowering the costs involved in accessing ESG data – both for reporting entities, as well as for end-users of the data. With more eyes watching, further integration of sustainability metrics in financial markets would benefit the quality and impact of sustainability information. This blog explores the idea of ESG data as freely accessible information[2].

Using and reporting ESG data are costly exercises (for now)

In a study undertaken by the European Commission on the anticipated costs of compliance for upcoming corporate disclosures under the new EU Corporate Sustainability Reporting Directive (CSRD), policymakers expect that the annual reporting cost of such disclosures for the 49,000 European companies in scope of the Directive will amount to no less than EUR 3.6 billion, with EUR 1.2 billion in one-off implementation costs.

These rising data and compliance expenditures will fall disproportionately on smaller companies that are not as well-equipped with sophisticated corporate social responsibility (CSR) or sustainability departments, like their large counterparts.

On the flipside, as ESG becomes increasingly relevant and disclosures – more sophisticated with more companies and other market players reporting, consuming ESG data is also becoming resource-intensive. The imperative of taking ESG into account has intensified in recent years, for reporting entities and end-users alike: ESG is truly entering the mainstream. Yet, the costs of accessing ESG data have not dropped as fast as the demand for ESG data scaled up.

Open-sourcing ESG data

What if ESG data became a public good? More accessible ESG data can serve the needs of market participants towards making better-informed and sustainability-driven investment decisions. At the same time, having ESG information as a universally available public good can empower individuals and consumers to make the right choices when it comes to the products and services they buy and invest in daily.

Of course, not everyone is interested (or capable) to keep track of sustainability information for their investments or purchases. But like public companies’ standard financial information, the ease of accessing standardized company data makes a world of difference. Newspapers and other media outlets facilitate information efficiency in financial markets and the economy also because the financial data of listed companies is considered a public good.

Practically, the right technology and efficiency-saving tools can reduce the marginal cost of standardized ESG data reporting and access. While it is unlikely that such a transition can take place overnight, enabling stakeholders to streamline their sustainability disclosures, centralize reporting and optimize for standardized data access can result in significant economies of scale. Capacity-building and technology will be at the heart of a better functioning sustainability data landscape that also tackles concerns of ‘greenwashing’ and misrepresentation of a company’s sustainability credentials.

Sustainability information could fall under a ‘digital global commons’ designation, meaning that this type of data is so important for achieving our global sustainable development agenda that it should be provided and accessible for free by members of the public and the contributing community, similar to the concept of cyberspace being available and accessible to all to use. Think Wikipedia, but for ESG data.

In the words of Mayo Fuster Morell, digital global commons info tends to be “non-exclusive, that is, be (generally freely) available to third parties. Thus, they are oriented to favor use and reuse, rather than to exchange as a commodity. Additionally, the community of people building them can intervene in the governing of their interaction processes and of their shared resources.” [3]

Further to that, in October 2020 the European Commission adopted its new Open Source Software Strategy 2020-2023. The key objective of the strategy is the possibility to reach European-wide digital sovereignty, enabling Europe to maintain its digital autonomy and spur innovation, creativity and breakthrough technological advances.

The benefits of publicly available sustainability data

Can we consider sustainability data as a digital global commons? To optimize for the number of viewpoints and impact, there is strength in the argument for making sure that basic access to ESG data and reporting should be better accessible to everyone, from the world’s largest publicly listed companies to the smallest family-owned enterprises. This level of transparency and freedom of information and disclosure would in turn enable the more efficient flow of capital towards businesses that truly meet the criteria for sustainable investing.

ESG data has its limits and greenwashing is a real issue. Some sustainability efforts fall under the marketing umbrella to appease consumers and investors who are willing and able to pay for an ESG ‘label’. Detailed and customized ESG analysis can become complex. Knowledge of ESG data can’t be free in all circumstances, but lowering the barrier to report and access ESG information would contribute to our joint understanding of how sustainability topics can affect our economies and long-term investment decisions. A better feedback loop between sustainability data providers (or reporting entities) and end-users would help address some of the pressing challenges behind integrating ESG data. It is an ongoing process of information retrievals, corrections and updates. Technology-driven transparency can highlight those organizations that do in fact take ESG seriously – and have them set the norm for others to follow.

[1] How to Combat Greenwashing? Find the Right Data Partner [1] These figures are additional to any EU Taxonomy related disclosure costs of EUR 1.2 – 3.7 bn in one-off costs, as well as EUR 600 – 1.500 million in recurring costs per year. Proposal for a DIRECTIVE OF THE EUROPEAN

[2] These figures are additional to any EU Taxonomy related disclosure costs of EUR 1.2 – 3.7 bn in one-off costs, as well as EUR 600 – 1.500 million in recurring costs per year. Proposal for a DIRECTIVE OF THE EUROPEAN

PARLIAMENT AND OF THE COUNCIL amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting.

[3] Fuster Morell, M. (2010, p. 5). Dissertation: Governance of online creation communities: Provision of infrastructure for the building of digital commons.