Emissions

Estimation Model

ESG Book’s machine learning solution to assess the estimated emissions of over 37,000 companies worldwide.

Request a demoESG Book’s machine learning solution to assess the estimated emissions of over 37,000 companies worldwide.

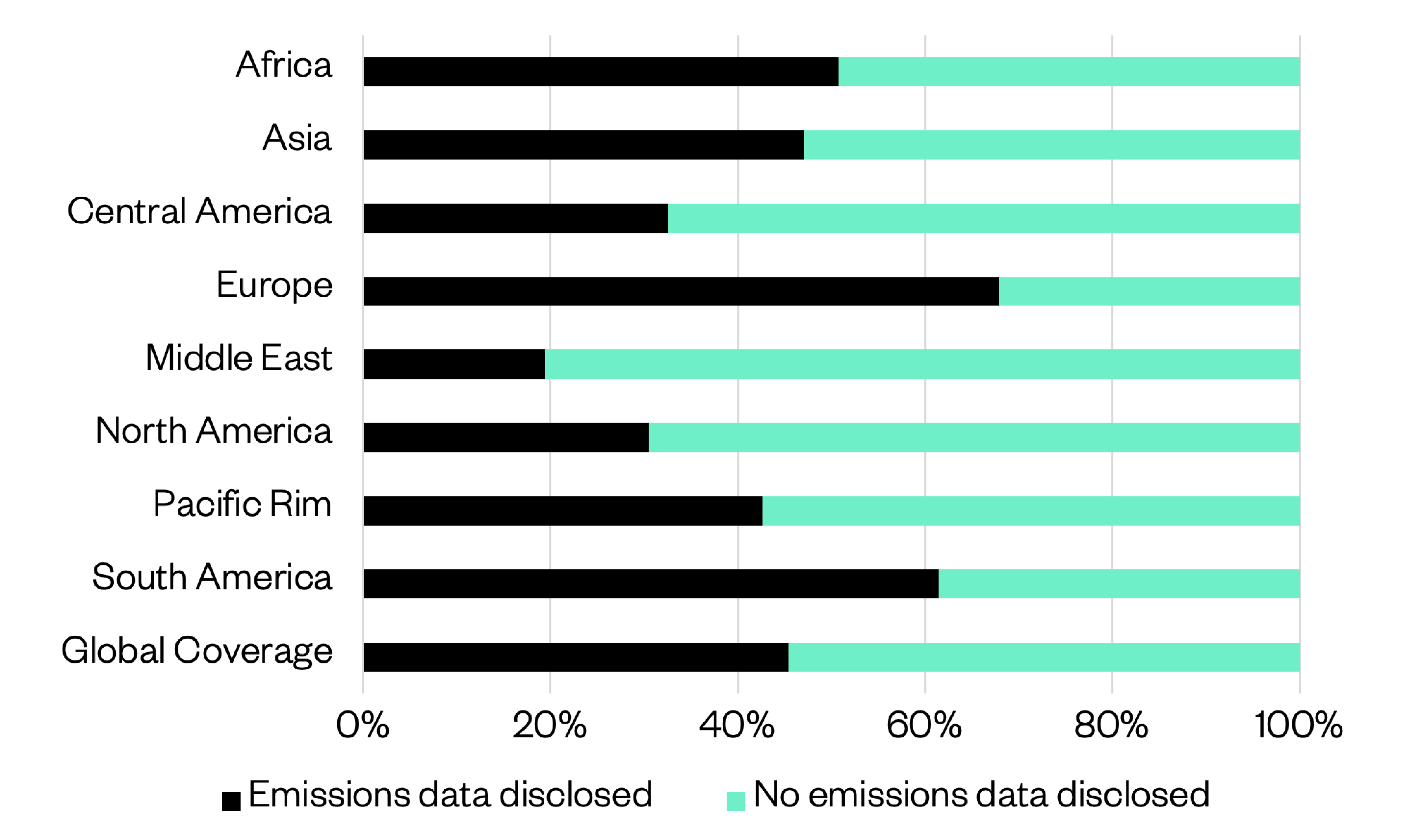

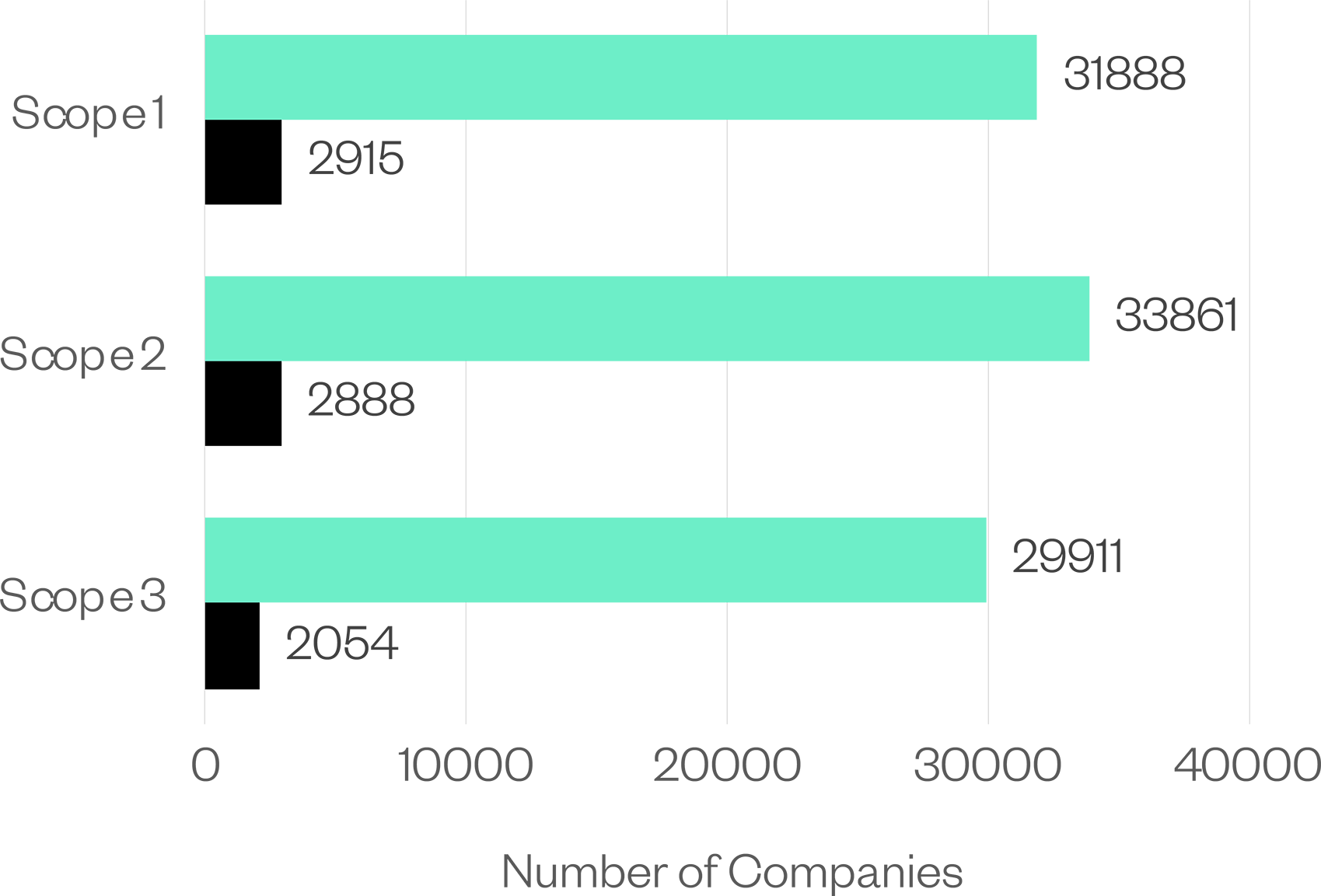

Request a demoWith the net-zero transition gathering pace, the climate impact of companies and investment portfolios is under ever greater scrutiny. However, the availability of publicly reported corporate emissions data is insufficient. Less than 4,000 of the world’s largest companies publicly disclose their carbon emissions, with vast disparities between sectors and countries.

ESG Book’s new Emissions Estimation Model provides financial institutions and investors with the estimated emissions data for over 37,000 listed companies, together with a confidence rating for each estimation, to enable a more transparent view of global corporate climate performance.

The model is the latest addition to ESG Book’s comprehensive climate data suite, which includes raw emissions data for companies globally across three scopes.

Companies covered

Scope 3 estimations

covered

Coverage of top

global indices

Sub-models

incorporated

Level regression

optimisation process

Greenhouse gas emissions data is essential for investors to understand portfolio alignment to various climate pathways, climate scenario stress-testing to identify transition risks and opportunities, and for engaging with and holding companies accountable on their progress to meet their net zero targets. It is also increasingly required for meeting mandatory disclosure regulations worldwide.

With a severe lack of reported emissions, however, in particular Scope 3 emissions, which account for 70% of the average company’s total emissions, financial markets are currently facing a data gap.

In response, ESG Book has developed the Emissions Estimation Model through a best-in-class machine learning approach to provide clients with greater transparency around the emissions of tens of thousands of companies worldwide.

Covering 99% of top global indices, the Emissions Estimation Model estimates Scope 1, Scope 2 and Scope 3 emissions for each company using independent, industry-leading models which incorporate the latest research on emissions estimation.

Emissions data disclosure is limited in the current reporting landscape.

ESG Book’s Emissions Estimation Model is comprised of over 800 sub-models, each developing relationships between available company level data and emissions, for a given industry, geography and emissions scope.

The Emissions Estimation Model’s inputs are carefully selected and processed to ensure that the model learns using accurate input data, while a 9-level regression optimisation process for each company selects the best emission estimate for each scope of emissions.

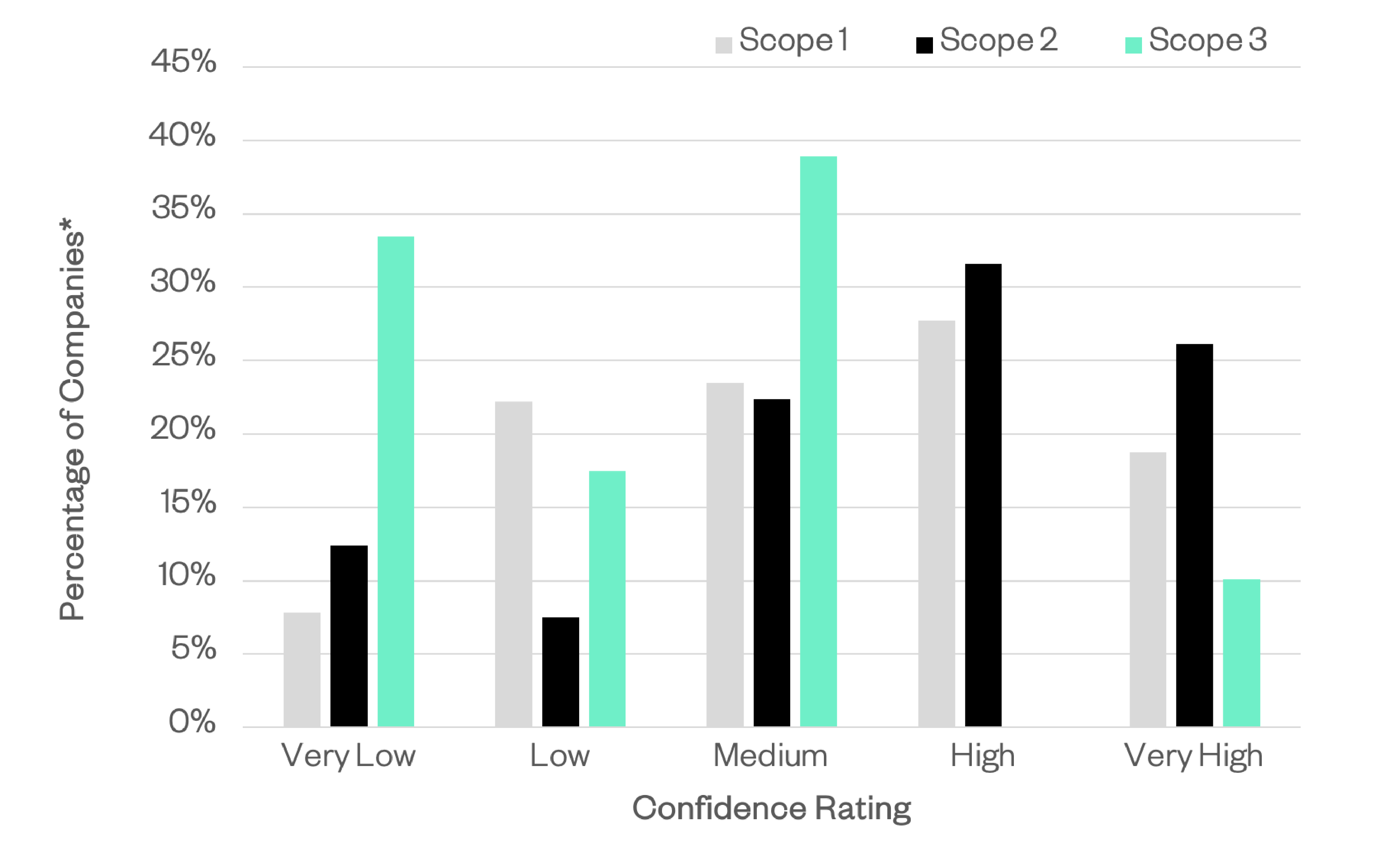

A confidence rating alongside each estimated figure also provides greater transparency and granularity into the degree of accuracy of the estimation.

Our approach has been trialled against conventional multivariable regression and other machine learning models, and has been found to predict emissions more accurately across sectors and geographies.

ESG Book’s model enables the estimation of emissions for tens of thousands of companies.

Our machine learning model uses a decision-tree algorithm to fine tune the relationship between the predictor variables and estimated emissions, allowing for greater model accuracy. The model incorporates best practices from existing research on emissions estimation, including the use of the Root-Mean-Squared Logarithmic Error (RMSLE) error metric which penalises underestimation of emissions.

The input predictor variables used in the Emissions Estimation Model are carefully selected to ensure they are the most relevant predictors of a company’s emissions. The input predictor variables are kept to a core set of 15 most commonly-disclosed metrics to increase comparability.

Our XGBoost machine learning model can handle missing input predictor variables when estimating emissions. This ability sets the model apart from other conventional regression or machine learning models, which estimates or fills missing data gaps with zeros.

A 9-level regression optimisation process ensures that the estimation with the highest accuracy is used in the final output.

Confidence ratings are provided with each estimation, enabling greater transparency and granularity into the accuracy of the estimated emissions. 5 levels of confidence from Very High to Very Low allow greater flexibility in selecting the estimations that are most suited to use cases or risk appetites.

Percentage of companies falling into each confidence rating for Scope 1, Scope 2 and Scope 3 estimated emissions.

Apply PCAF calculation to portfolios, using ESG Book’s 38,000+ strong database of company-reported and estimated emissions data with the aim of replacing estimates with reported data.

Evaluate progress on net-zero commitments at a company and portfolio-level through GFANZ-recommended metrics such as implied temperature rise or net-zero benchmark divergence.

Inform decision-making in portfolio construction by evaluating a range of climate risks and opportunities of the underlying company holdings.

Assess portfolio companies’ progress against net-zero commitments, utilising ESG Book’s framework-aligned disclosure platform.

Support reporting of regulatory and industry disclosure requirements across SFDR, EU Taxonomy, TCFD, GFANZ and other net-zero alliances.

Contact us to learn more about ESG Book’s solutions